What You Need to Know About Sea Limited: Shopee's Secret Playbook

Sea Limited Deep-Dive Part 2: Shopee

To give you a sense of the high-quality research delivered to members of The Deep-Dive, I am sharing with you Shopee’s Secret Playbook to becoming the most dominant player in Southeast Asia.

P.S. I have a gift for you at the end of the email.

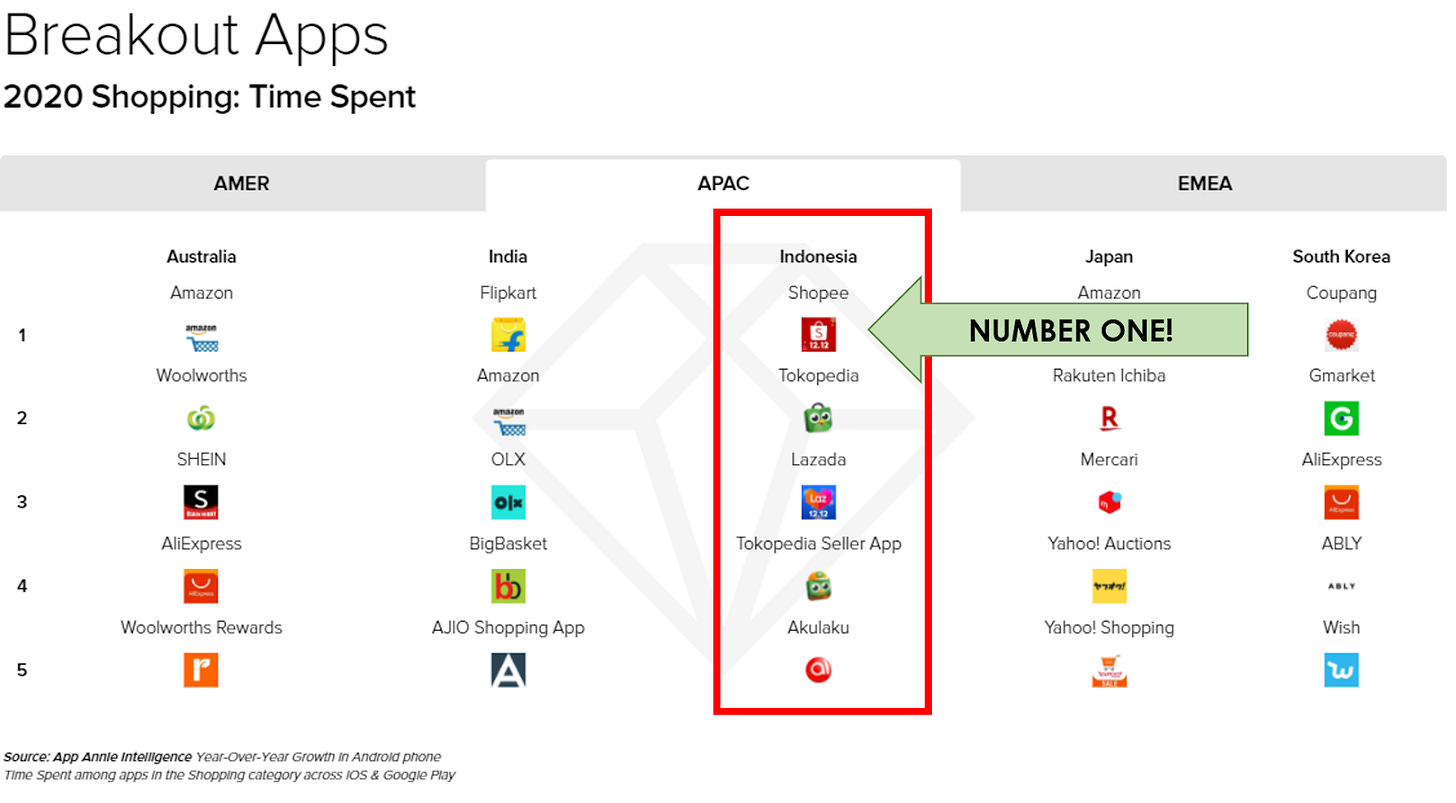

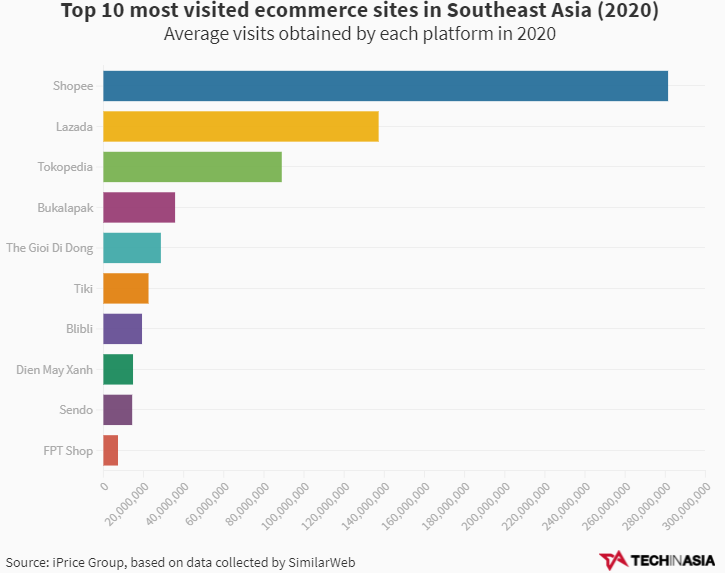

Shopee Tops The Charts!

Topkopedia launched in 2009, Lazada in 2012, and Shopee is the latest eCommerce platform to enter the region in 2015. Despite being the latest entrant, Shopee swooped in and took the number one spot!

How Did Shopee Become No. 1 Despite Being The Last Entrant To The Market?

As we have seen in the Garena deep-dive, gaming is in the DNA of Sea Limited and they have applied many of their strategies for Garena to Shopee. Even though they are the newest player in the Southeast Asia eCommerce battle, Shopee has risen to the top by leveraging their late-mover advantage.

Shopee’s Secret Playbook

Mobile-first approach

Back in 2015, existing eCommerce players Lazada and Tokopedia were focused on websites as their main platform. Shopee took a different approach by launching as a mobile app first given Southeast Asia’s high mobile penetration rate.

Similar to the effect of social media apps, adopting a mobile-first approach means an increased engagement rate as users are captive to the dopamine rush of Shopee games, discount coupons, and flash sales.

Gamified shopping experience

Designing the customer experience primarily for a mobile app gave them a leg up in gamification of the shopping experience, so much so that Shopee is dubbed the mobile game that was designed to be inclusive of both genders (or, perhaps specifically targeting females would be a more accurate statement).

“As the attention span of users gets shorter, eCommerce players need to come up with different ways to keep them engaged”, says Pan Yaozhang, head of data science at Shopee. “This can include games, live streaming videos, and other interactive features.”

In Shopee Farm, players water a plant and receive a reward when it is fully grown. Friends can water each other’s plants, which encourages players to rope others into the game and onto Shopee’s platform.

The act of getting your friends' help to water your plants is significant in two ways!

Firstly, introducing the social element greatly enhances the stickiness of the platform and increases the frequency of users opening the Shopee app. This increases user engagement and forms a habit cycle, where a user is rewarded for opening the app and watering the plant routinely and penalized for breaking the habit cycle (i.e. forgetting to water their plants).

Secondly, it turns existing users into Shopee evangelists as they rope their friends for help with the game, reducing Shopee’s customer acquisition costs (CAC).

This has been especially well-received in markets like Thailand, Indonesia, and Vietnam, where shopping is a very social affair.

The most popular in-app games have ‘group play modes’ that offer users greater rewards when they invite and play with friends.

Making Shopping Online Social

Making shopping on Shopee a social event is key to increasing engagement. After all, shoppers already have a habit of showing off their purchases to friends on social media (e.g. Instagram), why not shift this demand within Shopee?

Shopee Feed

Users can see what friends have been buying through the Shopee Feed, turning online shopping into a communal experience. Much like Facebook feed, customers can follow friends and sellers, receive real-time updates on purchases, deals, and other events happening on Shopee.

Shopee Live Chat

Another social feature is Shopee Live Chat which enables direct conversations between buyers and sellers, encouraging quick discussions and clarifications before any transaction occurs.

This is important as shopping in Asia is a social activity and consumers often need to speak with merchants (or haggle 😅) before deciding on a purchase.

Shopee uses machine learning and natural language processing to develop real-time translations for the chat feature to overcome the language barrier. A translation model matches two or more languages together, allowing for example, a Singaporean buyer to send a message in English, and for the Indonesian seller to receive it in Bahasa Indonesia.

“This (real-time language translation) allows for smoother interactions when users shop for overseas products on Shopee,” says Zhou Junjie, Shopee’s COO.

In a region that speaks at least nine different languages, helping buyers and sellers understand each other is paramount.

Hyperlocalization

Southeast Asia is fragmented and its consumers are diverse. A huge part of Shopee’s success is how decentralized and localized they are.

Shopee has a separate app for each country, to ensure that the design and offerings are customized to their consumer preferences and culture. Whereas its competitors like Lazada, only have a single app to cater to the entire region.

When driving marketing campaigns and raising awareness, Shopee uses different modes of engagement for each country.

For instance, to reach a wider audience in Indonesia, Vietnam, and the Philippines, Shopee worked with its local teams to run TV shows, a more traditional medium that was reflective of local pop culture tastes. These shows were synced with in-app activities to boost traffic for the eCommerce marketplace’s brand partners.

Working Closely With Merchants

I often hear from merchants on the Shopee platform that Shopee provides the best support. Shopee works closely with merchants to rethink their strategies in different regions and connects them with consumers for feedback and reviews.

In an interview, Kimberly-Clark shared that Shopee held strategic planning workshops to disrupt the Malaysian market. This gave them insights into the products that were best suited for the local market. The company also participated in Shopee’s Super Brand Day, an initiative by Shopee that features one selected brand per day and Kimberly-Clark achieved 36x growth in sales.

Shopee also has a Brand Membership program, which is a brilliant move to enhance the stickiness of the platform.

With the loyalty program built into Shopee, merchants and consumers alike would be incentivized to be repeat customers on the platform instead of shopping on competitors’ platforms.

Celebrities Endorsement

Shortly after Shopee launched in 2015, Alibaba took over Lazada in 2016 and with their centralized approach, they installed their homegrown leadership in charge.

This influenced Lazada’s marketing, as executives in Lazada favored growth ideas around quantifiable performance due to how their incentives were structured.

According to Kr-Asia, “Lazada ... eventually resorted to its old playbook of paid ads on Facebook and Google ... because ad-driven traffic in Southeast Asia is cheaper than in China, the return on investment for this action is high, which translates to better performance reviews in Alibaba’s internal evaluation system.”

Shopee on the other hand, hired their first brand ambassador: K-pop mega-group Blackpink to promote their 12/12 campaign.

Huge spending on celebrity brand ambassadors is a wasteful and risky use of capital in Alibaba and Lazada’s point of view

They failed to appreciate how high-profile celebrity ambassadors could increase brand awareness, bringing in more traffic in the long run.

Since then, Shopee has engaged many brand ambassadors (with a local flavor), with their catchy jingles, went on to make waves all across Southeast Asia.

Building Trust

One of the biggest deterrents for consumers purchasing products online is the lack of trust. Especially for food and skincare products, where safety is critical, trust is the top priority.

“Well, I know that Wrigley is a satisfactory product, whereas I don’t know anything about Glotz’s. So if one is 40 cents and the other is 30 cents, am I going to take something I don’t know and put it in my mouth—which is a pretty personal place, after all—for a lousy dime?”

—Charlie Munger

In Southeast Asia for instance, many buyers resisted buying infant formula online because of concerns about expiry dates, authenticity, and damaged products.

To address this, Shopee came up with the Shopee Milk Guarantee, which certifies that a product is authentic and is at least six months from its expiry date.

Shopee also launched Shopee Guarantee, where payments are held in Shopee’s escrow account to ensure that orders are successfully fulfilled before payment is released to the seller.

Garena’s Cash Flow

The success of Garena Free Fire meant that Shopee has deep pockets. In Q1 2021 alone, it brought in an EBITDA of $717.3 million!

Its competitors who took plenty of venture capital (VC) money and are under pressure to show profitability in the near term. And at some point, VCs patience will wear out and funding will dry up.

Shopee on the other hand can rely on Garena and the capital market for capital to build the strength of its flywheel.

Apart from investing heavily in its brand awareness, Shopee also doubled down on free shipping. This adds positive momentum by improving the customer experience and attracting new sellers to Shopee because they know they can make more sales.

Sellers and merchants are platform-agnostic, they will flow to whoever takes the least commission, and can provide the most benefits (e.g. shipping subsidies and web traffic).

This is important because the secret sauce to creating a formidable platform is to establish the eCommerce flywheel.

(End of Preview)

Going Deeper

I hope you enjoyed reading Shopee’s Secret Playbook!

Gain access to the remainder of Shopee’s Deep-Dive, in addition to the complete access to The Deep-Dive archives by becoming a member today.

In this deep-dive, you will learn about:

Why is Shopee replicating China leading tech players’ strategy to become a Super App?

What are the eCommerce trends in Southeast Asia and the region’s hidden potential?

Why is Shopee growing rapidly in Latin America and what are they doing right?

Why is Sea Limited such an attractive investment despite it being loss-making?

What are the key metrics we need to keep an eye on as investors?

Special Gift (Subscribers Only)

Take a 20% lifetime discount by entering “SHOPEE” when you join us at The Deep-Dive.

Coupon valid till 9 August 2021. Don’t miss out!

If you want to find out more about The Deep Dive membership, reach out anytime via DM (Twitter, Linkedin or Instagram) or contact@steadycompounding.com

Best regards,

Thomas Chua