To give you a sense of the high-quality research delivered to The Steady Compounders, I am sharing with you a segment of the final piece of Sea Limited’s puzzle—SeaMoney to becoming the most dominant player in Southeast Asia.

Serving The Underbanked

🚨 Approximately 50% of Indonesians and 60% of Filipinos do not have a bank account!

Before the rise of digital wallets like ShopeePay, (1) bank transfers and (2) cash on delivery were the most popular method of making payments for eCommerce.

A lack of proper payment infrastructure will impede major sales events such as the upcoming Shopee 9.9 2021 mega sales!

There’re two major problems with payment by bank transfers and cash on delivery.

#1 - Cart Abandonment 🛒

As you can imagine, paying through bank transfer causes a lot of friction for consumers’ checkout experience.

It starts with consumers entering their login ID, password (don’t get me started on the process of retrieving lost passwords), keying in the long chain of the merchant’s bank account number, get the OTP, and then it’s going to take 2 to 3 business days before payment is successfully remitted.

All this process is going to take at least 5 minutes, and imagine having to do this multiple times a day on heavy sales days like Shopee’s 9.9 Super Shopping Day.

It’s a nightmare!

Here is why solving payments is essential—The average shopping cart abandonment rate is 74.52%

There are many reasons why people abandon their cart for cart, and a long checkout process is one of the major reasons. Research shows that cart abandonment significantly increases if the checkout process takes more than 2 to 3 minutes.

With ShopeePay, it enables consumers to checkout products in a few seconds! By topping up your digital wallet in advance, you can check out your items on Shopee seamlessly with just one click.

#2 - Trust Issues 🤔

Without a digital payment solution, there is a lack of trust between online buyers and sellers.

Buyers may be at risk of receiving fake goods and sellers may be at risk of receiving counterfeit bills or no-shows upon delivery.

Lacking trust, buyers resisted buying online and sellers hesitated to sell their products online.

This was why launching ShopeePay is key to Shopee’s eCommerce dominance in Southeast Asia—consumers’ payment needs weren’t served by its traditional banks.

With online payments, Shopee launched Shopee Guarantee, where payments are held in Shopee’s escrow account and released only after orders are successfully fulfilled.

This reassures sellers that buyers have put up the money and buyers that their money can be recovered if they don’t receive the goods!

Mobile Wallet Offerings

ShopeePay and Airpay are SeaMoney’s mobile wallets, which provide users with easy access to digital payment services—online payments, top-up wallets, transfer and withdraw funds, and make payments offline at thousands of our merchant partner locations, offering users a seamless shopping experience.

Here are the markets ShopeePay and AirPay are in:

According to Snapcart Indonesia’s survey in March 2021, ShopeePay was the most used, the most remembered and most liked mobile wallet by Indonesian consumers during the first quarter.

In addition to leveraging on-platform use cases on Shopee, Sea Limited is doubling down on its expansion to its range of offline use cases.

For example, ShopeePay is available as a payment option at Indomaret, one of Indonesia’s leading convenience store chains. In the first week of ShopeePay’s partnership with Indomaret, more than 1 million transactions were paid using ShopeePay!

The company is also constantly adding new features to the ShopeePay experience to enhance online to offline functionalities.

For example, its “Mall Around You Promo” or “Deals Near Me” shows users attractive deals in their immediate vicinity. Users can purchase the relevant vouchers on the app and redeem them immediately at the physical outlets (I admit I’m quite addicted to this deal-hunting experience).

Shopee partners with numerous offline malls and SME chains (affectionately known as mama shops in Singapore) to make ShopeePay available to a broader base. Their efforts have been accelerated by Covid-19, given that people are increasingly looking for alternative contactless payment methods given that the region’s credit card penetration remains low and costly.

Indonesia’s central bank plans to fix e-wallet transaction fees at 0.7%. Slightly above what Alipay and Wechat Pay cost at around 0.5%.

Transaction fees are just the low-hanging fruit.

The real aim of an e-wallet is often to transform into a super app – a one-stop place for e-payments, eCommerce, ride-hailing, food delivery, and other services.

(End of Preview)

Going Deeper

I hope you enjoyed reading The Final Piece of Sea Limited’s Puzzle—SeaMoney!

Gain access to the remainder of SeaMoney’s Deep Dive, in addition to the complete access to archives by becoming a member today.

In this deep-dive, you will learn about:

SeaMoney’s complete offerings: Mobile wallets, offline payment services, financing, and cash loans.

What are management’s strategies to growing SeaMoney?

Banking licenses and why start Sea Capital?

Who is the talent behind Sea Capital and why it matters?

Key metrics and valuation of Sea Limited.

Special Gift (Subscribers Only)

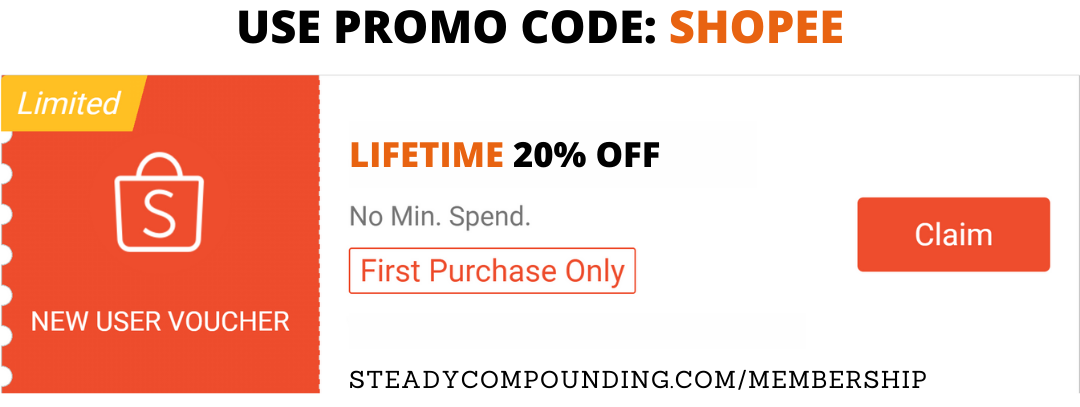

Take a 20% lifetime discount by entering “SHOPEE” when you join us as a Steady Compouder!

Coupon valid till31 August 2021. Don’t miss out!

If you want to find out more about Steady Compounding Membership, reach out anytime via DM (Twitter, Linkedin or Instagram) or contact@steadycompounding.com