Starbucks, Inflation, and Is It Time to Buy the Dip?

Dealing with stock market pullbacks

Normally, I get really uncomfortable when asking people for help and I hide the request to share this email all the way at the bottom, buried beneath so much content that most of you probably never see it.

But today, I’m putting it right at the front.

If you enjoy or get value from Steady Compounding, please help me get to 10,000 subscribers by the end of 2021 by doing any of the following:

Forwarding this email to friends and telling them to subscribe

Share on LinkedIn, Twitter, and Facebook with a short note

Share within your existing community or company Slacks

Hi everyone,

My new business breakdown on Starbucks is ready! Excited to share this analysis with you because Starbucks was my first multi-bagger and it taught me the beauty of looking at companies that have the capabilities to compound my wealth for years to come.

The lessons learned from this investment set me up well to buy into Facebook and Google when prices were depressed, both of which have become multi-baggers for me as well.

In this premium breakdown, I look to cover:

Starbucks Business Model

Management Growth and Capital Allocation Plans

Moat

Deep Brew (Artificial Intelligence) and Americas Trade Area Transformation

Strategies in China (e.g. 飞快 “feikuai”)

Valuations

If you haven’t already, do consider becoming a premium member today! Take a free month’s subscription and lock in the 20% off with the coupon “20OFF”.

The new launch deal will end by this month or after the first hundred subscribers, whichever comes first.

I. Inflation Causing the Market to Tank?

'I remember the $0.05 hamburger and a $0.40 per hour minimum wage, so I've seen a tremendous amount of inflation in my lifetime. Did it ruin the investment climate? I think not.' —Charlie Munger

Markets move up and down all the time, there’s no need to find reasons for a false sense of security. When dealing with inflation, the best solution is to own companies that are able to pass on the price increases to consumers, and are able to increase their sales without much need for additional capital investment (e.g., buying machinery etc., which would be susceptible to inflation).

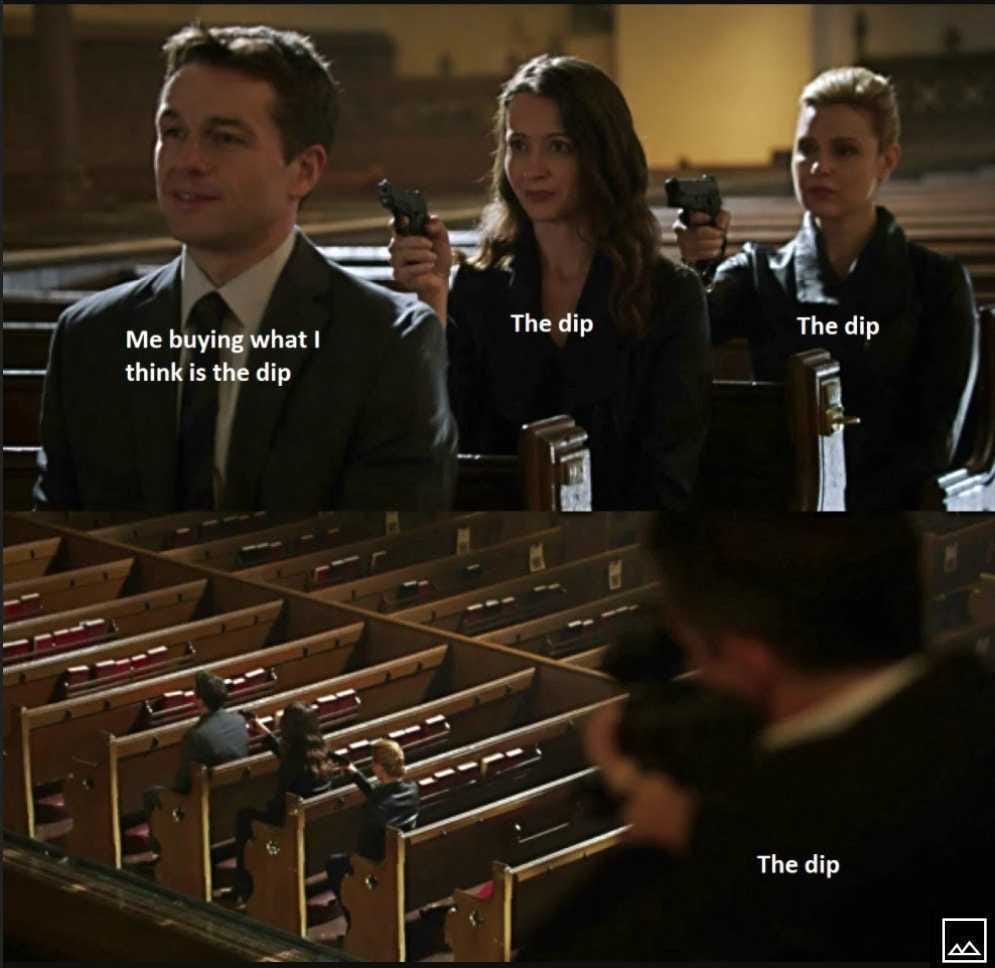

II. Buy The Dip?

In March and more recently, investors who are invested in growth stocks probably seen their stock prices plunged hard. Our limbic system and our amygdala which sits within (colloquially known as the Lizard brain) will hijack our mental capacities.

It’s important for us to understand the role of the amygdala, it plays a crucial role in steering our emotions such as fear and anxiety, which is what keeps us alive when we run into dangerous situations.

The problem is it gives out the same response when the stock market is tanking, which causes us to panic even though most of these companies have crushed earnings this season.

There’re three things I do to prepare myself for volatility like this:

Write out my investment thesis, journal my emotions and perform conservative valuations before making an investment. You can only be emotionally ready by preparing beforehand, and by developing the conviction for your companies based on conservative assumptions.

Ensure that I have emergency funds, insurance, and that I only invest money that I do not need for the next 5 to 10 years. This gives me the holding power necessary to ride out the volatility.

Don’t read the news. News are in the business of getting your attention, and the best way to do it is to make everything sound like doomsday.

If you’d like to know how I perform valuations for these fast-growing companies, consider subscribing to my premium membership for my report on Twilio. More importantly, it is crucial to understand how durable the business is, and I spend a lot of time in my in-depth report covering these aspects.

III. Tracking Super Investors

The 13-F season is here again, and many hedge fund managers will be publishing their quarterly letters during this period.

Apart from Charlie Munger, Mohnish Pabrai, Tom Russo, and Akre Capital Management have established a position in Alibaba.

Give this post a like if you would like me to do a run-down on Alibaba!