Meta Is Down 23% Post-Market, What Happened?

Click here if you prefer to read using your browser.

Meta released its Q4 2021 earnings and this was what happened:

beating revenue estimates, the company missed on EBIT and EPS estimates. The operating margins compression was largely a result of a temporary increase in general & administrative expenses (primarily legal related expenses which tends to be lumpy) and to a lesser extent a mild increase in R&D and marketing expenses , which is not cause for concern.

There are three main reasons for concern:

Competition (TikTok)

Users growth flatlining

Apple iOS changes

Let’s address each of them.

1. Competition (TikTok)

The next pivot will be to consume video content in Reels, similar to the transition from desktop feed to mobile feed and stories.

A video-first platform like TikTok has gained popularity due to improved mobile networks and phone cameras, especially among younger people.

Reels have gained traction on Instagram and to a lesser extent on Facebook. Reels is monetizing at a lower rate than Feed and it is cannibalizing the users' time spent (and therefore revenue) on Feed, just like their introduction of Stories when Snap first came out.

As CEO, Mark has led the company through various transitions, and Meta is working to build up Reels' flywheel by making it as easy as possible for creators to share and monetize content.

There will be some pressure on impression growth near-term, but it is important to focus on the growth of Reels.

Excerpt from earnings call

The rapid growth of TikTok or the younger generation's preference for video-first content appears to have slowed Facebook's growth of users.

2. Users Growth Flatlining

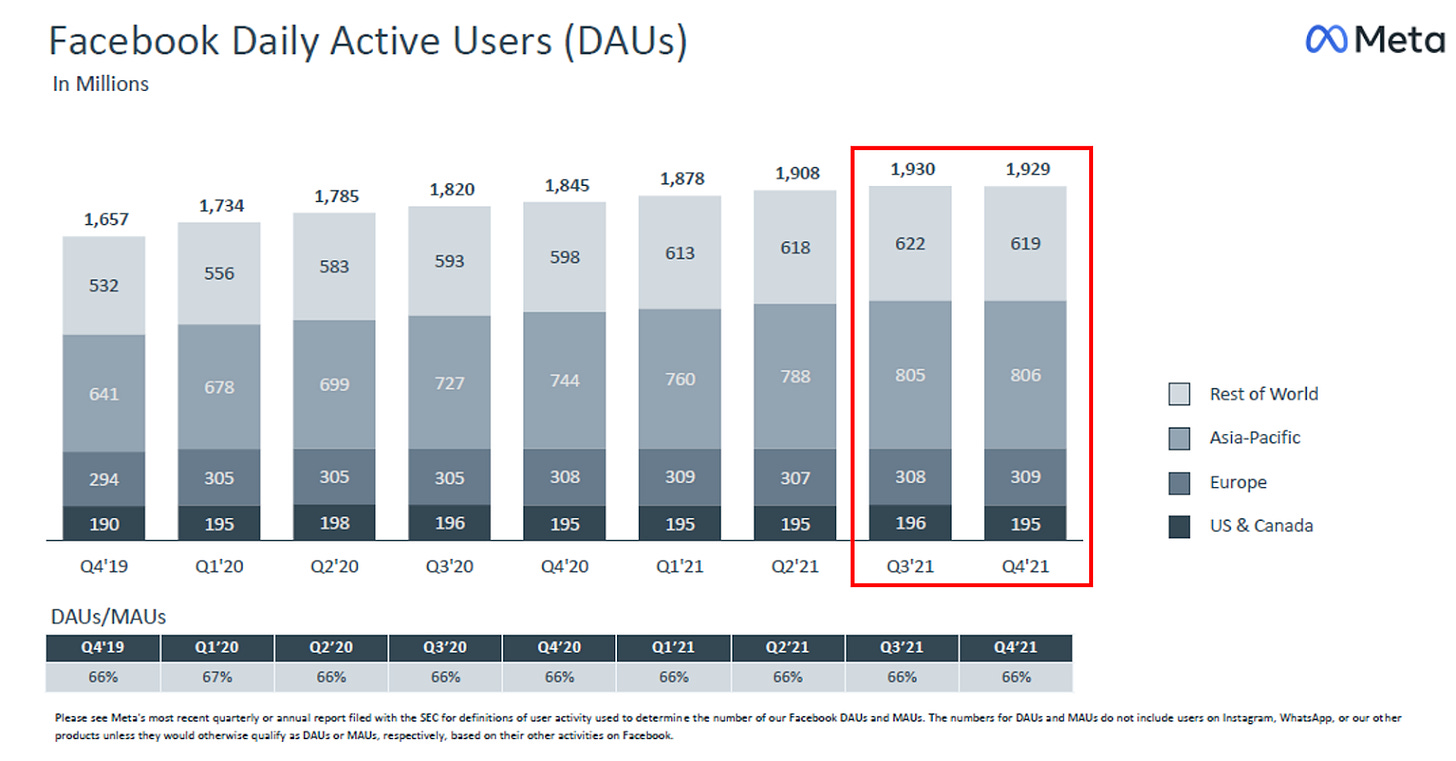

I was surprised to see that Facebook’s growth has stalled, specifically with its user base in Asia-Pacific.

Here is what management said, “Facebook user growth was impacted by a few headwinds in the fourth quarter. In the Asia Pacific and Rest of World, we believe COVID resurgences during prior periods pulled forward user growth. User growth in India was also limited by an increase in data package pricing. In addition to these factors, we believe competitive services are negatively impacting growth, particularly with younger audiences.”

Asia-Pacific has a population of 3.24 billion people excluding China. Approximately 68% of the population has a smartphone, or 2.2 billion. The plateauing of Facebook's user growth at 0.8B indicates that it failed to capture the video-first generation and that it was losing eyeball time to TikTok.

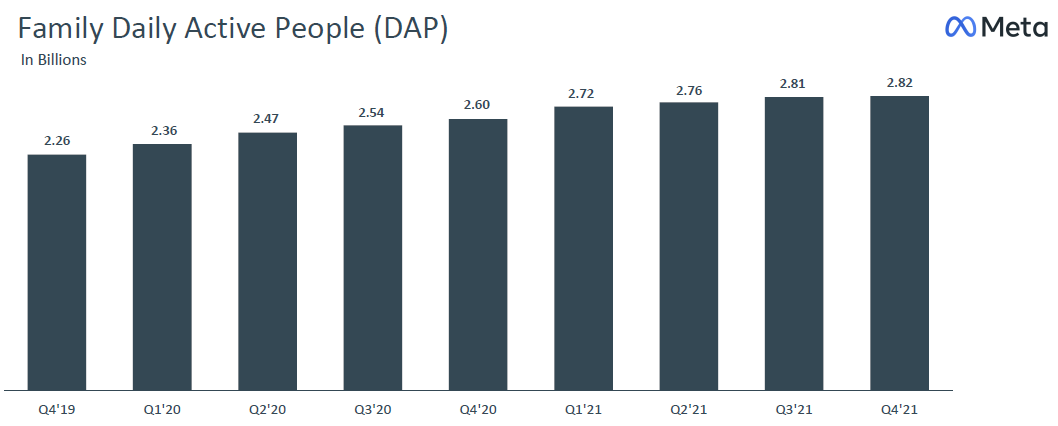

There is a silver lining in that the number of family daily active people (DAP) including WhatsApp, Instagram, and other services rose from 2.81 billion to 2.82 billion.

While Facebook’s growth is starting to flatten out, Instagram will be key to Meta’s push into video content via Reels.

3. Apple iOS Changes

According to management, Apple iOS changes cost the company $10B in ad revenue!

There were two problems caused by Apple iOS changes:

First, it affected the effectiveness of targeting ads. Meta will have to figure out how to better target ads with less data quickly.

The second issue is that advertisers have a difficult time measuring conversions and ROI on their marketing spend. During sales season, advertisers monitor their ROI and decide whether to increase spending on an hourly basis. If ROI cannot be measured on a timely basis, it will affect the marketing spend on Meta's platform.

All social media platforms, with the exception of Google, will be affected by the iOS changes. During the earnings call, management went on to explain why Google was unscath from the iOS changes:

“We believe those restrictions from Apple are designed in a way that carves out browsers from the tracking prompts Apple requires for apps. And so what that means is that search ads could have access to far more third-party data for measurement and optimization purposes than app-based ad platforms like ours. So when it comes to using data, you can think of it that it's not really apples-to-apples for us. And as a result, we believe Google search ad business could have benefited relative to services like ours is based a different set of restrictions from Apple. And given that Apple continue to take billions of dollars a year from Google Search ads, the incentive clearly exists for this policy discrepancy to continue.”

Google pays Apple over $10B a year to remain the default search engine on iPhones. However, would users switch to Apple's search engine if it were launched? Until we see how the most recent iOS impacted everyone else, it's hard to understand why Google paid Apple a ton of money.

Conclusion

As recently as 2021, the earnings call was filled with antitrust concerns. Clearly, TikTok is a formidable rival, and Apple is the real gangster with its fight against Epic (creator of Fortnite) and iOS updates to stall Meta.

As the company transitions to short-form video, we will have to observe Reels adoption and whether they can launch a flywheel effect in this space. Instagram needs to develop tools that are easy-to-use and powerful for users to create video content.

In addition, we will need to watch how Meta adapts to the changes in iOS. Granted, they should be least affected of all the social media companies, but that does not make it okay. It will be necessary to monitor how Meta provides targeted ads with minimal data and bridge the data lag so that marketers can get immediate feedback on their campaigns.

Disclaimer: This post constitute the author’s personal views only and are for educational purposes only. It is not to be construed as financial advice in any shape or form. From time to time, the author may hold positions in the below-mentioned stocks consistent with the views and opinions expressed in this article. Disclosure – I hold a position in Meta at the time of publishing this article (this is a disclosure and NOT A RECOMMENDATION).