8 Insights from Studying The Best Fund Managers

Over a 15 year period, 90% of active funds can't beat the market.

I've spent months studying the top 10% who do.

Here's what I learned:

1. Invest like businessmen.

When you buy a stock, you are buying part of an enterprise.

Whether it's 10 shares of Facebook or several million shares.

Consider it no different than if you were buying the company in its entirety.

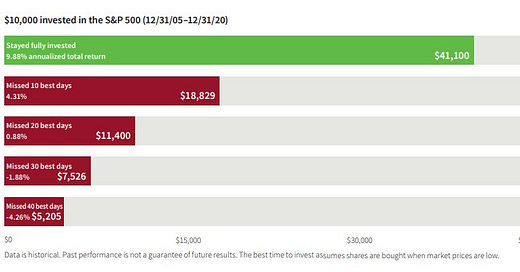

2. Staying invested.

Timing the stock market is a fool's errand.

To obtain returns on the markets, you must first be invested.

Miss the 10 best days and your returns will be halved.

3. Taking advantage of Mr. Market.

When euphoric, he only sees the bright side of things and demands a high price.

On other days when all he sees is dark & dreary, he goes on a fire sale.

The irrational attitude of Mr. Market provides opportunities for the grounded investor.

4. Require a margin of safety.

When building a bridge to support a five-ton truck, build it so that it can support ten tons.

Likewise, valuation is a highly subjective analysis with a wide margin of error. Buy with a margin of safety to protect your capital.

5. Know the limits of your circle of competence.

If you are not familiar with FDA approval process or the science behind a drug, you should probably steer clear of pharmaceuticals.

To realize better turns than others, you must have better knowledge than others.

6. Know when to sell.

Ideally, the time to sell is...almost never.

But there're 3 instances where we might need to sell:

•Our analysis is wrong

•Prospects of business have deteriorated

•There's a better opportunity

7. Learning from mistakes.

Mistakes are inevitable.

The key is to recognize them quickly and learn from them. Four common types of mistakes:

•Mistakes of commission

•Mistakes of omission

•Price anchoring

•Overconfidence

8. Have a constructive attitude.

Rational investors do not chase fads or run away from crises.

Always have the humility to learn, unlearn and progress.

That’s the end of this post! If you have found it useful, share it to help more people find it :)

Thanks for reading! If you haven’t already, do consider joining us as a premium member and gain access to stock analysis on high-quality growth companies.

Companies covered: Twilio, Facebook, Sea Limited, Alibaba, Crowdstrike, and more!