3-Bullet Sunday (Munger doubles on BABA, Steve Jobs on Why Some Monopolies Fail, & Does Experience Matters in Investing?)

Happy Sunday!

I try to have only timeless content on my blog SteadyCompounding.com

If you are interested in my day-to-day ramblings on the market, stocks and new stuff I read about investing, you can find me on my socials!

[Most Active] Twitter (@steadycompound)

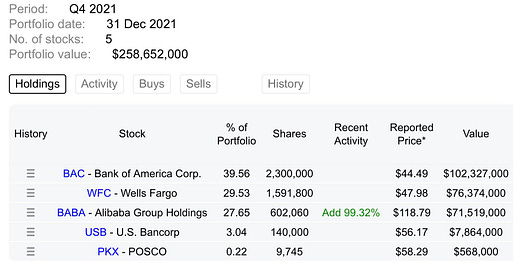

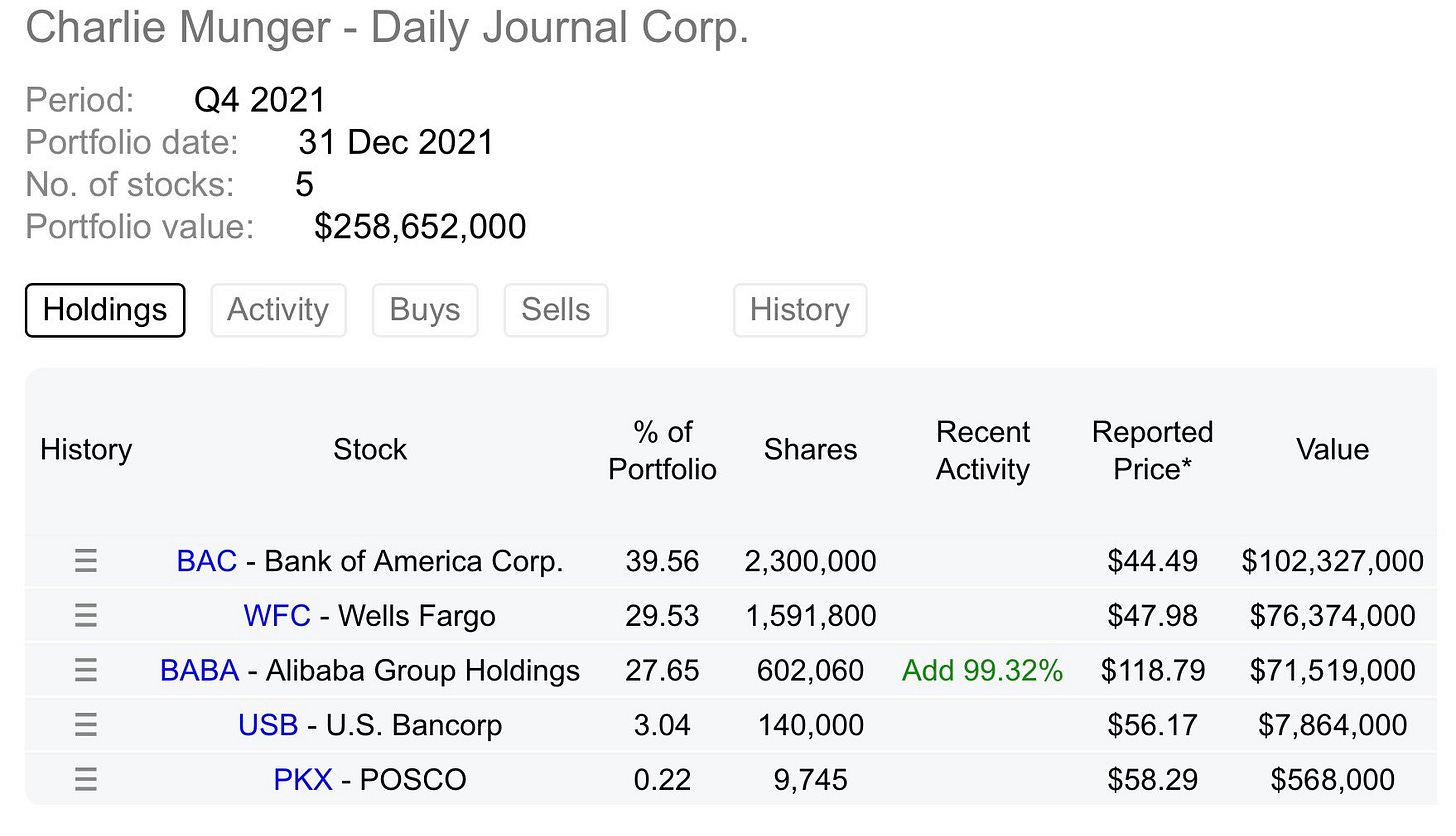

I. Charlie Munger doubles BABA again!

Munger’s shares held in BABA:

Q1 - 165,320

Q2 - 165,320

Q3 - 302,060

Q4 - 602,060

“The wise ones bet heavily when the world offers them that opportunity. They bet big when they have the odds. And the rest of the time, they don't. It's just that simple.”

—Charlie Munger

Alibaba is a sprawling business with many moving parts which took me months to fully grasp.

I have already done the heavy lifting for you and distill the key insights into my research report.

If you wish to read my two-part deep-dive on Alibaba, become a member today.

II. Steve Jobs on Why Monopolistic Companies Fail

TLDR:

The product geniuses who got Xerox and IBM to monopolistic status are silenced overtime.

What’s the marginal benefit to inventing something new when you’re the monopoly in the short run? Zero!

The person who made all the difference is the sales person, and they’re the one who get promoted.

Overtime, the heart of the product dies off.

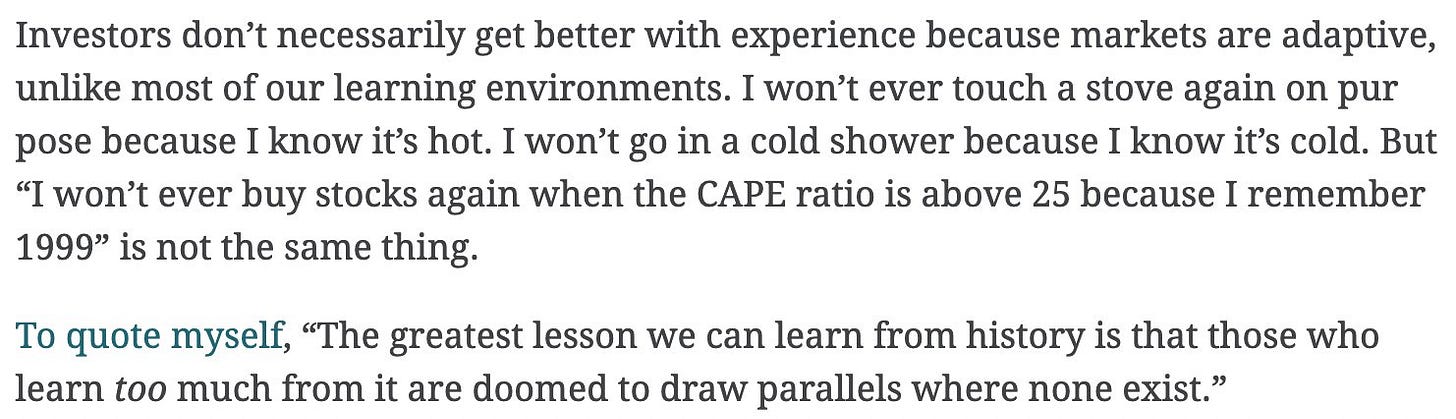

III. Investors don’t necessarily get better with experience

Investors constantly need to learn, unlearn and relearn because the markets are adaptive.

It's not just experiencing that matters.

Excerpt from The Irrelevant Investor:

Read Here: 10 Lessons from 2021

That’s all from me this week.

Till next time!

Thomas Chua