The markets had another rough week, and you are probably used to hearing everyone say:

“Buy when there’s fear on the streets.”

"Revenue growth will be the biggest driver of returns in the long run."

The stock market is a voting machine in the short run. Over the long run, it is a weighing machine. Focus on the fundamentals, not the stock prices."

These quotes are great. It’s like investing porn on Fintwit, similar to the frequent hustle porn you see on LinkedIn.

I am holding onto some stocks, rotating out of my lower conviction stocks to higher conviction stocks, and slowly investing my cash every single week.

I’m not immune to the effects of volatility, but one thing I’m not doing is going to cash.

Having invested for a while, I know the instinct to run when the market plummets must be avoided like the plague. And this is where we are supposed to do the opposite.

Here, having a game plan before shit hits the fence becomes crucial. Before our amygdala seizes our rational brain.

That said, if your portfolio drawing down another 50% will seriously affect your finances, relationships, or mental health, then take action.

Learn from this drawdown, lick your wounds. Nothing teaches you more about your own risk tolerance, the importance of position sizing and the importance of having an emergency fund than a sharp drawdown.

With that in mind, let's begin this week's 3-Bullet Sunday with an important message:

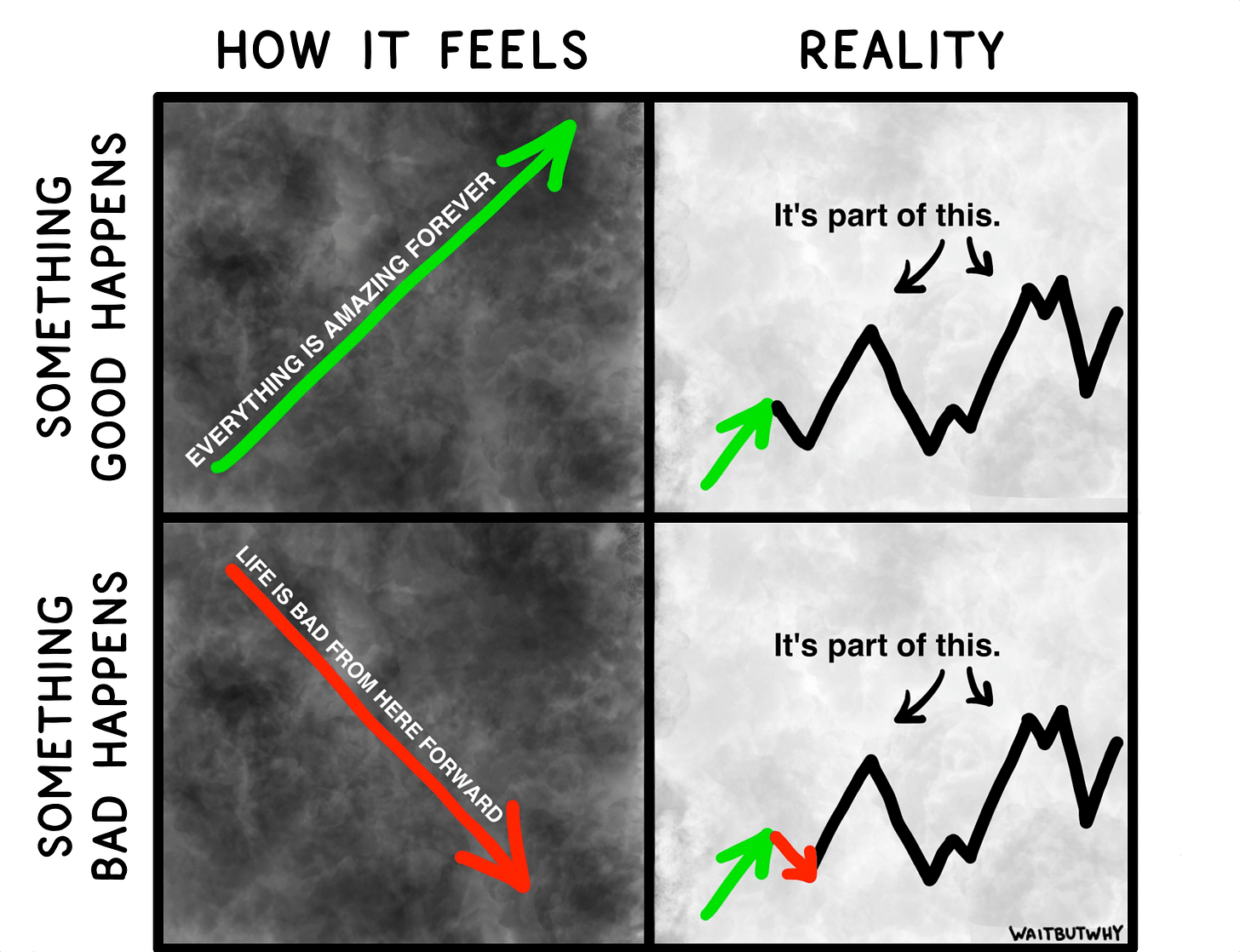

I. Don’t Forget to Zoom Out

II. There’s Always Something to Worry About (Peter Lynch)

In the short run, many things may cause stocks prices to fluctuate.

Overtime, share prices will track revenue and earnings growth.

Focus on what matters.

III. Casualties of Your Own Success by Morgan Housel

Evolution has a bias towards animals evolving larger over time.

Being larger means getting better at capturing prey, travelling or having bigger brains.

But it could also means being more vulnerable.

Likewise for companies, the same force that gave them advantages to scale could also set them up for self-destruction.

Read Here: Casualties of Your Own Success by Morgan Housel

IV. Bonus Point!

If you like to quickly build up your watchlist of stocks to consider during this sell-down, join us as a premium member, let us do the heavy lifting and gain access to our full library of companies research reports!