3-Bullet Sunday (Facebook Deep-Dive, My Most Gifted Book, PE Ratio, Multi-Baggers)

Dear readers,

Happy to share that the Facebook deep-dive [paywall] is out! The company, led by its 37-year-old founder, owns four of the five most popular social apps and is generating a huge amount of cash.

Find out why Facebook deserves a place in my portfolio!

If you haven’t joined as a member, join us here today!

I. The Boy, the Mole, the Fox and the Horse.

A really beautiful book by Charlie Mackesy.

Check out some of his drawings:

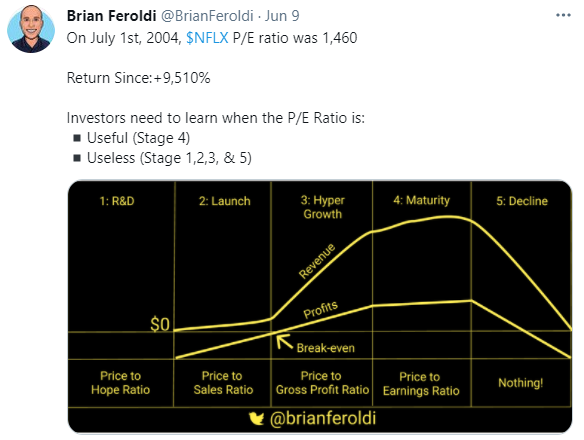

II. P/E ratio is predominantly useful for mature companies only.

III. Buy and Selling by Chris Mayer, author of 100 Baggers.

Two key takeaways from this article:

(1) Many investors are worried about macro events (e.g., inflation). What’s in the headlines today seems so important now… and then seems quaint even just a few years later. It is a mistake to adjust your portfolio based on these concerns of the moment, if you are interested in nabbing those wonderful 100 baggers (or any multi-baggers).

Those multi-baggers need time to come to fruition. You won’t get there trying to trade around recent events. You’ll need to own great businesses and leave them alone.

(2) When we sell a company we think is over-priced to buy another one we think is cheaper, think of the things that could go wrong:

You could be wrong about the stock you are selling

You could be wrong about the stock you are buying

You have to pay taxes on your gains

The riskiest position in your portfolio is the newest position. It’s the idea you know the least. Doesn’t matter how much time you spent researching it, there is something about owning a position for a period of time. You know what you own better than what you don’t. Ergo, any new idea has to be significantly better than what it replaces.