Lessons from Yen Liow, Big Tech Earnings, and more!

Hi everyone!

It’s earnings season and our big tech companies (Facebook, Google, Amazon, etc) showed really stunning results. I’ll cover more in the latter half of this newsletter!

This week, I wrote about Yen Liow’s investing philosophy with running a long-short fund and his thoughts on portfolio allocation. This interview is super insightful and I hope you enjoy it as much as I did!

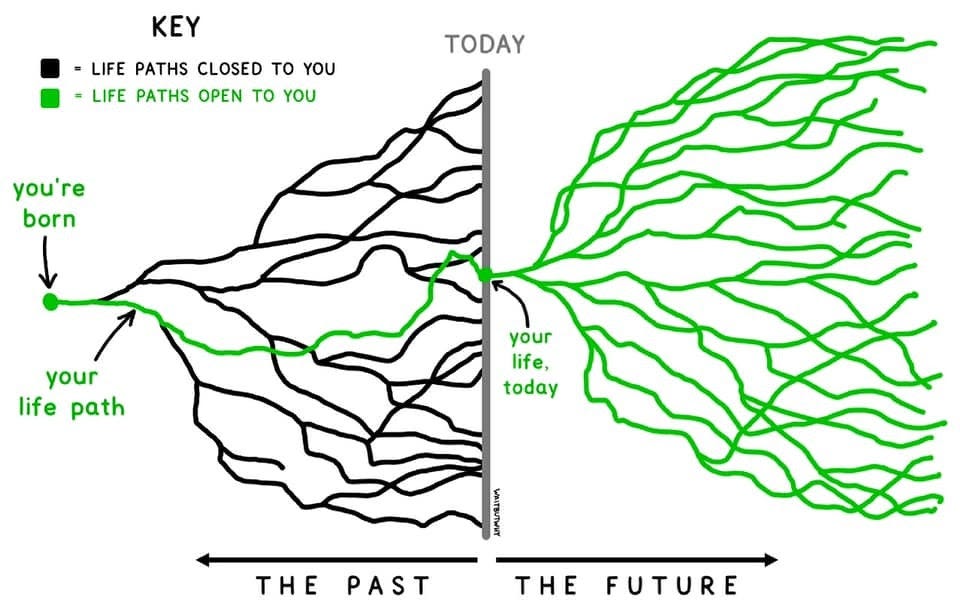

I. We spend a lot of time thinking about those black lines, forgetting that it’s all still in our hands.

Image from waitbutwhy

II. When Elephants Dance!

Facebook grew revenues for Q1 by 48% to $26.2B and operating profits by 93% to $11.4B, operating margins have recovered back to above 40% levels. Free Cash Flow for Q1’21 alone came in at $7.8B. It’s almost like they are printing cash.

Daily Active Users (DAU) for FB rose 8% to 1.88B (yeah, the bear thesis is nobody uses them anymore?), DAU for its family of apps (FB, IG, WA) rose 15% to 2.72B.

The number of impressions (i.e., number of ads served) rose 12%, and average price per ad rose 30%. So much for the boycott (i.e., stophateforprofit campaign) against Facebook.

On Apple IOS14 and increased regulations, the earnings call response by Sheryl Sandberg offers good insight. It’s all a relative game, these regulations are going to impact all companies and FB’s data points is going to yield better result vis-à-vis its competitors. Companies will still have to advertise and with tighter regulations on data collection for all social media companies, FB will end up with the best data pool.

Think of cigarettes—when the lawmakers forbade tobacco companies from advertising, it actually enhanced Philip Morris’ (e.g., Marlboro) competitive advantage as new players are unable to penetrate into consumers’ minds.

In this sense, regulations sometimes enhance the competitive advantage enjoyed by the most dominant player.

To top it off, here are the next big plans for FB: AR/VR, Social Commerce, and the Creator Economy. I highly recommend listening to the earnings call for this.

Google grew revenues for Q1 by 34% to $55B and operating income by 106.1% to $16.4B. Its operating margin increased by 10.3% to 29.7%.

Search, Cloud and YouTube reported some insane numbers. Search grew by 30.1% to $31B, YouTube by approximately 50% to $6B, and Cloud by approximately 46% to $4B.

Just to put it in context for YouTube: if the current growth trajectory continues, YouTube will book between $29B to $30B in revenue for 2021. Netflix is expected to report $29B for 2021.

The difference? YouTube doesn’t have a bunch of upfront costs for media production, they have user-generated content, and they only pay content creators after they have gotten their cut of ad revenue.

III. Berkshire Hathaway Annual General Meeting

The long-awaited BRK AGM is finally here! For this year, Buffett will be flying over to Los Angeles to join Charlie Munger for the event.

Give this newsletter a like if you like me to share my notes on the AGM with you!

P.S. I have finally launched my premium membership! I do in-depth research reports of high-quality companies and break them down into digestible content. If you’d like me to simplify your research process or learn how to analyse a company, consider subscribing today!

Take 20% off the price by using coupon “20OFF”.