17 Lessons From Warren Buffett’s Annual Letters To Shareholders

Join 3,203 intelligent investors and subscribe to the Steady Compounding newsletter today!

Click here if you prefer to read on a browser.

Buffett's letters taught me more about investing than any business school ever could.

Even after investing for 14 years, I uncover new insights every time I reread his letters.

Recently, I reread his letters from 1977 to 2020 for a third time.

Here are my key insights:

1. Moat is NEVER stagnant

A company's competitive position either grows stronger or weaker each day.

Widening the moat must always take precedence over short-term targets.

2. Commodity businesses

A business without moat will have its returns competed away.

Regardless of improvement, your competitors will quickly copy your advantage away.

Where returns on capital is dismal, reinvestment will only destroy value.

3. The flywheel effect

Buffett was preaching about the flywheel effect before it became cool.

Back then, newspapers were similar to today's platform businesses like Amazon, Meta, and App Store.

More readers beget more advertisers beget more readers.

4. Operating leverage

Companies with high fixed costs and low variable costs will see earnings rise faster than revenue.

However, it cuts both ways. It becomes a disaster when revenue is declining.

Check out my article on how operating leverage works.

5. Fundamentals of investing

•Know your circle of competence

•Focus on future cash flows

•Refrain from price speculation

•Ignore volatility

•Macro is a waste of time

6. Mr. Market

Everyday Mr. Market will show up to name a price to buy or sell.

When optimistic, he sees only favorable factors and names a high price.

When pessimistic, he sees nothing but trouble and names a low price.

Mr. Market is here to serve you, not to guide you.

7. What is risk?

Risk does not come from price volatility.

Nor could it be managed away by simply diversifying. Focus on whether after-tax proceeds generated by the investment provide at least as much purchasing power as the investor started with, plus a modest interest rate.

8. Growth vs Value Investing

Thinking that stocks with low PE, PB or high dividend yield is a value stock is erroneous thinking.

Likewise, a high PE, PB or low dividend yield might be a value purchase.

Instead, focus on the return on capital vs the cost of capital.

9. Durable businesses

Similar to Jeff Bezos, Buffett like to focus on what doesn't change for a business.

For Amazon's customers, it is low prices.

For Sees' candies, it is for the premium brand.

Technology changes, but motivations less so.

10. Investing in "The Inevitables"

Between fast growth or a more certain growth, Buffett will always choose the latter.

Without durability, fast growth in the early years are less ideal investments.

11. Investing in quality

Over the long-run, the returns of your investment will mirror the underlying business return on capital.

Even if a business is slightly overvalued, Buffett will rather hold on to it than to switch for a cheaper, lower-quality business.

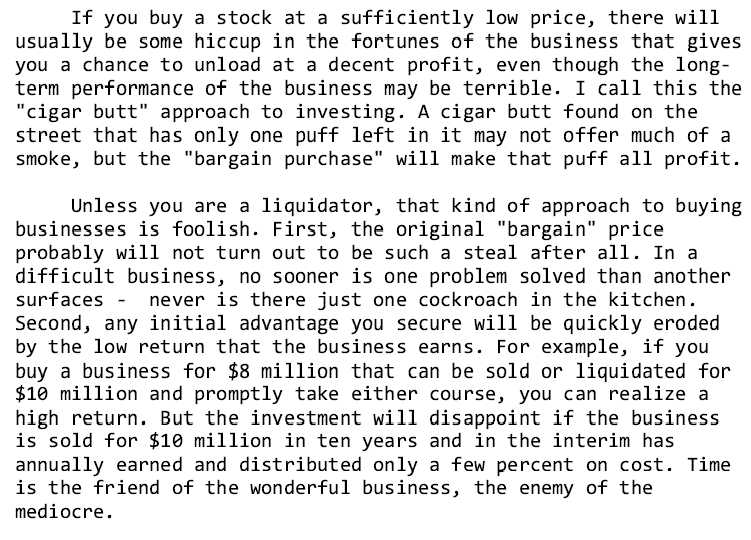

12. Deep value investing

Investing in ugly businesses simply because of its price is foolish.

Time is the friend of the wonderful business, the enemy of the mediocre.

Unless you are able to liquidate the company, you'll slowly see value evaporate.

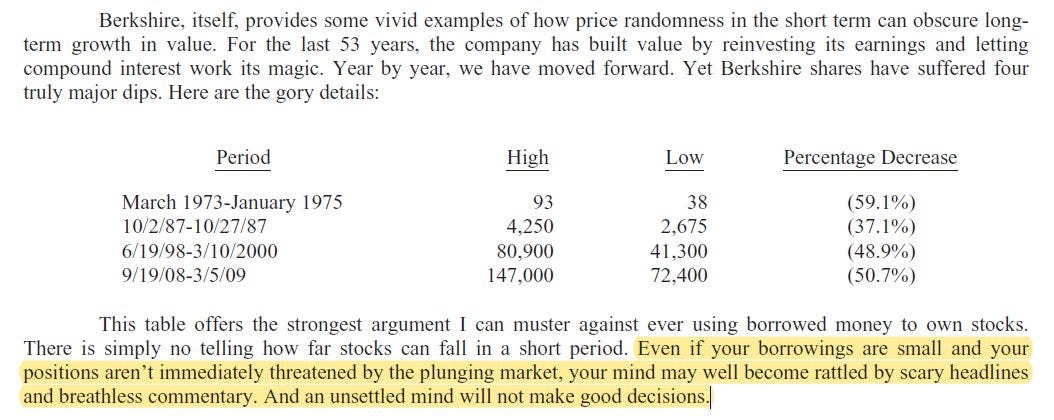

13. Leverage

Don't do it.

Don't expose yourself to the possibility of being wiped out.

In investing, a settled mind is crucial for making decisions.

14. Share buybacks

Makes sense only when:

•The company has enough fund to maintain competitive position

•There's no where else to reinvest at attractive returns

•The company's stock is selling below intrinsic value

15. Not all earnings are created equal

An asset heavy business that requires frequent reinvestment to maintain its competitive position doesn't have "real earnings".

Bulk of its returns will be set aside simply to maintain its competitive positioning and cannot be distributed.

16. EPS is misleading

When evaluating an acquisition, management often justify it with EPS accretion.

But near-term EPS is of no significance.

What really counts is whether a merger is dilutive or anti-dilutive in terms of intrinsic business value.

17. Inflation

Asset-light companies that have pricing power will benefit from inflation.

On the other hand, companies that have to invest in machineries, plants and properties to stay relevant will suffer in periods of high inflation.

This is the end of my key takeaways from Buffett's letters!

I hope you enjoyed it. If you like this, please share it to help others find it.

Thanks for reading! If you haven’t already, do consider joining us as a premium member and gain access to stock analysis on high-quality growth companies.

Companies covered: Twilio, Facebook, Sea Limited, Alibaba, Crowdstrike, and more!