16 Lessons from Fundsmith's Annual Shareholder Meeting 2022

Terry Smith has often been dubbed the English Warren Buffett

Click here if you prefer to read in a web browser

Many people refer to Terry Smith as the "English Warren Buffett".

He spoke at Fundsmith's latest Annual Shareholder Meeting about:

•His stake in Amazon, Facebook and Google

•Why he continues to hold PayPal despite the recent disappointment

•Inflation & interest rates

• Ukraine-Russia war

Here are my notes:

1. The pandemic has caused quite a bit of distortions

To overcome the distortions, evaluate businesses (and the fund results) based on two-year stacks.

I.e. How has the company/fund done compared to 2019?

Rather than looking at the YoY performance.

2. Winners keep winning

Microsoft has made its 7th appearance to be the top contributor to the fund's performance.

Run your winners.

Water your flowers and pull out your weeds.

Not the opposite (which many do).

3. On PayPal

Multiple years of success except for recent months.

Still a strong business with a great market position.

But management lost their way with acquisitions.

Should have focused on getting its users to use PayPal more frequently instead.

4. On Amadeus

Airline reservations continue to be problematic which led to underperformance.

Continue holding as it will survive and emerge stronger with a more powerful market position.

Largely because they are better financed than its competitors.

5. On Valuation

A Ford doesn't price the same as a Ferrari .

The fact that one is priced lower than the other doesn't in itself tell you anything about the bargain you are getting.

We need to examine other factors such as growth & quality as well.

6. New Position in Google

On top of Facebook, another route for them to get into the digital advertising market.

Continues to take share away from traditional advertising.

Third largest player in the cloud computing infrastructure market.

7. New Position in Amazon

AWS is highly profitable and has decades of growth.

Profitable 3P transactions have increased significantly (56% of sales).

Prime members has 200m members and is a powerful profit driver.

Advertising segment benefits strongly from ATT.

If you want to get up to speed on Amazon's investment thesis, become a member of Steady Compounding and gain access to my 25-page Amazon's in-depth research report! Click here to become a member today!

8. Returns are Persistent

Good businesses tend to stay good.

And Fundsmith focuses on good businesses because they are investing for the long-term.

Energy and banks are generally bad businesses.

This "rotation" is temporary and it doesn't make them become good.

9. ROC is Persistent for Industries

This chart compares the ROC between:

1963-2004 VS 1995-2004

Industry with poor returns remains poor and vice versa.

"Over the long term, it's hard for a stock to earn a much better return than the business which underlies it earns." — Charlie Munger

10. Main Determinant of Investment Outcomes...

Isn't what's happening in the short-term: inflation, interest rates, Ukraine-Russia war

The most important thing is to invest in good businesses that can reinvest at high ROC.

And whether they have the fortitude & patience to stay invested.

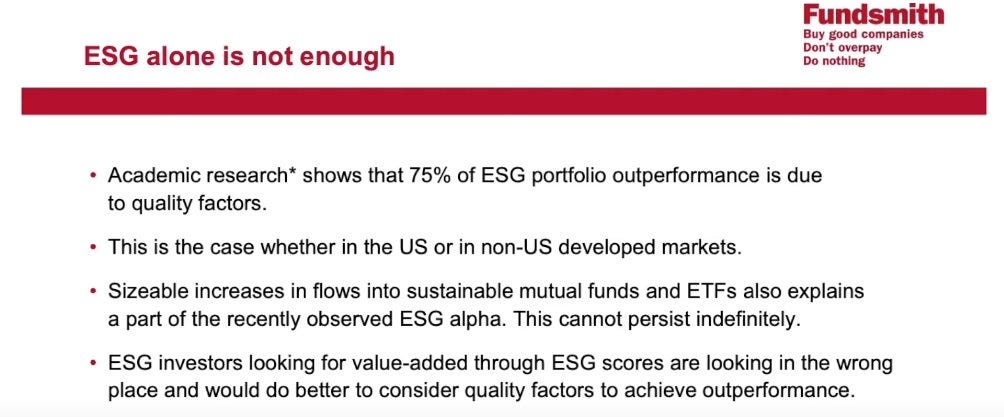

11. On ESG

Big marketing tool, Terry remains cynical.

If sole focus is on ESG, it'll not drive Alpha.

It always goes back to ROC, cash conversion, margins, and reinvestment to build its moat.

12. The War in Ukraine

If history is any guide:

"Buy on the sound of canons" — Nathan Mayer Rothschild

Most of their companies have no significant exposure to Russia.

Russia is a resource economy, not a consumer goods nor tech economy. Fundsmith isn't affected much.

13. Why hasn't he sold Unilever?

Terry has frequently criticized Unilever's management.

But continues to hold them because they're fundamentally a good business.

Holds plenty of great brands.

It's easier to change the management than to change the quality of the business.

14. Meta's investment in the metaverse

The company is spending heavily on data centers to prepare for the metaverse.

But it isn't speculative spending.

Tim Cook from Apple echoed similar sentiments about the metaverse.

Valuing it based on Meta's ad business alone, it's very cheap.

If you want to get up to speed on Meta's investment thesis, become a member of Steady Compounding and gain access to my 20-page Meta's in-depth research report! Click here to become a member today!

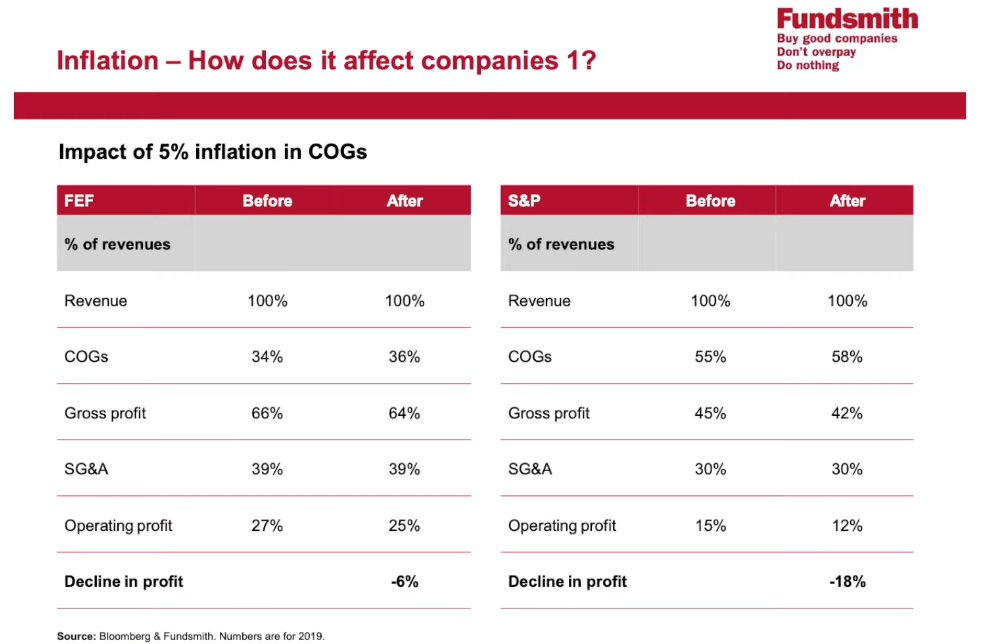

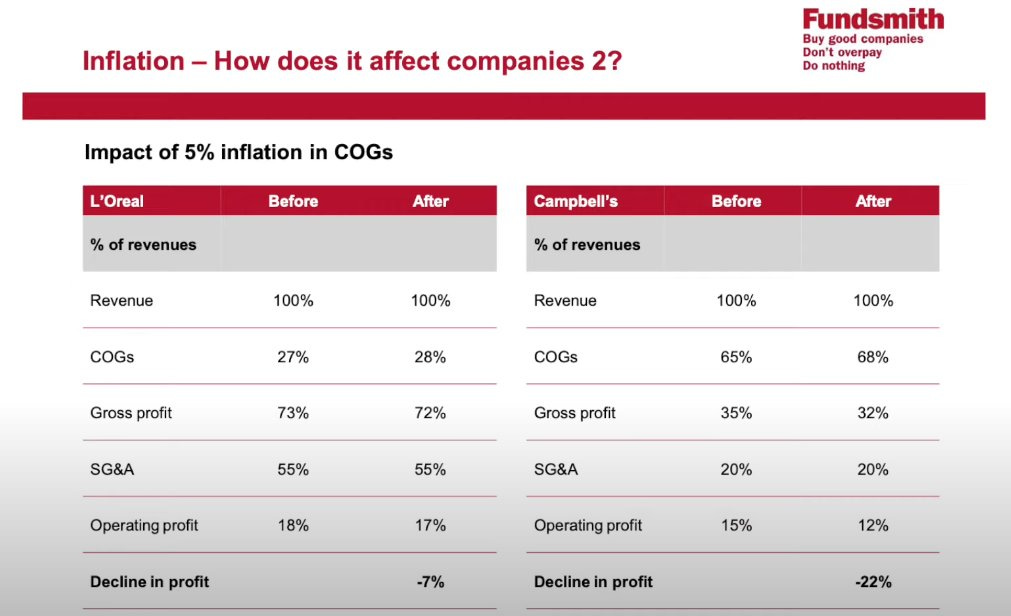

15. On Inflation

Not all companies are impacted equally.

The biggest frontline of protection is not having COGS a big % of expenses.

Companies with high GPM will defend themselves better in times of inflation.

During periods of high inflation (>5%), quality companies will outperform the index.

Historically, it only underperformed during one of the high inflationary period.

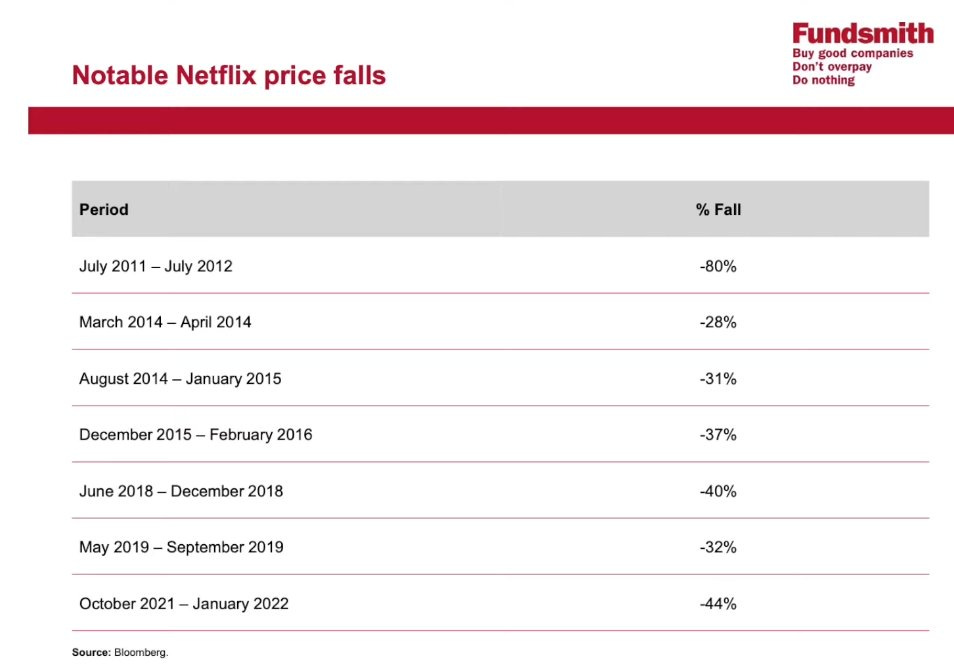

16. On Volatility

If volatility makes you uneasy then the stock market may not be for you.

Netflix has multiple drawdowns (as shown in the chart).

But if you held it from 2010-2022, it's a return of 5,992%!

In the end, share prices follow fundamentals, not the other way around.

And that’s a wrap! I hope you have found this helpful.

If you like to watch Fundsmith’s ASM video, click here.

Join the Tribe!

If you like posts like these, you might enjoy my weekly newsletter: 3-Bullet Sunday

I write about business breakdowns, investing concepts and timeless lessons from super investors. Join here: 3-Bullet Sunday.