10 Lessons from Jeff Bezos on Investing, Business and Life

At 30 years old, Jeff Bezos left his cushy career in banking to start an online book store.

His letters as the CEO of Amazon are a treasure trove of insights into investing and life.

I have consumed all of Jeff's letters & interviews since 1997.

Here is what I have learned:

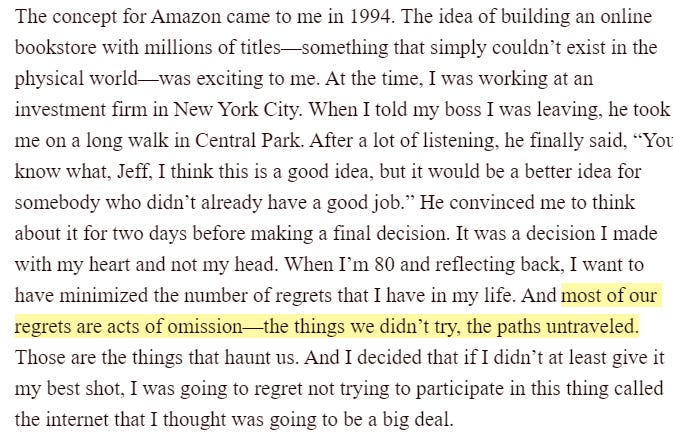

1. The regret minimization framework

Jeff would imagine himself at age 80, "What have I regretted in life?"

And work backwards to guide your present decisions.

Most of our regrets are from the things we didn’t try, the risks we didn’t take, or the paths we didn’t travel.

2. It's all about the long-term

Competition is sparse when you are competing in decades.

Many companies make decisions based on the next three to five years.

Bezos is investing for the next two decades.

3. Maximizing shareholder value

A company's value today is the present value of future cash flows.

85% of a company's value are from year 3 and beyond.

Invest today to ensure that a company achieves durable growth in the future.

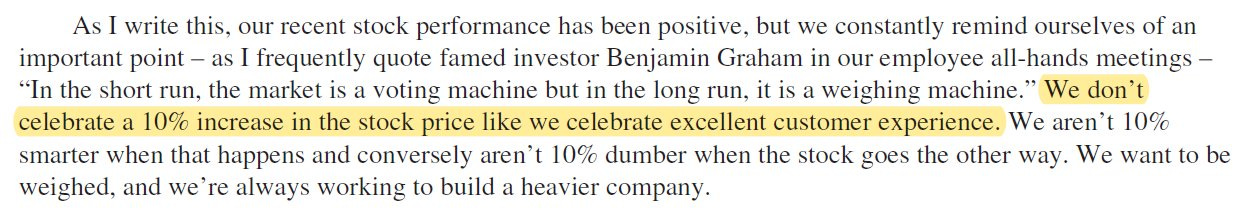

4. Focus on the customers

Focus on solving problems and the share price will take care of itself.

Share prices in the short-run has no indication as to how well the company is doing.

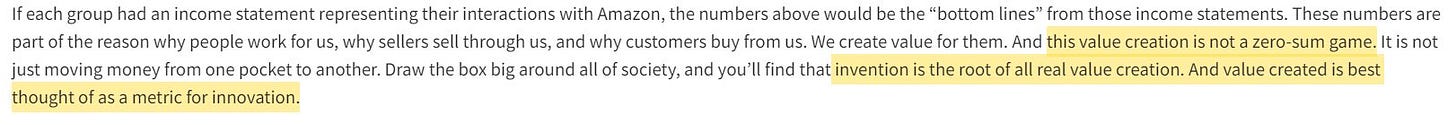

5. Create more than you consume

At the heart of everything, it's about creating value.

Value creation is not a zero-sum game.

It is why people work for Amazon, why sellers sell on Amazon and why customers buy on Amazon.

6. Resist the pull to be normal

The universe will try to pull you back if you try to be different.

But do it anyway.

There's a price to pay to be distinct.

But to be distinct is to survive.

7. Developing conviction

Often times bets with great risk-reward ratios look crazy.

And conventional wisdom will tell you you are crazy & wrong.

This is where your work & conviction comes in.

8. Surround yourself with greatness

Jeff Bezos' hiring questions:

1. Do we admire this person?

2. Along what dimension is this person a possible superstar?

3. Will this person raise the bar for their team?

Fight the entropy of mediocrity, keep raising your talent bar.

9. Don't be afraid of failure

To innovate is to try.

To try is to risk failure.

Focus not on the outcome, but on the learnings.

And keep getting better.

10. Make good decisions — fast

Most decisions are reversible and should be made quickly.

As an organization grows, there's a tendency to indulge in bureaucracy for all decisions.

Being over conservative & moving too slowly may be the riskiest of all.

That’s it!

If you like this, share it to help others find it.

Best,

Thomas Chua

Thanks for reading! If you haven’t already, do consider joining us as a premium member and gain access to stock analysis on high-quality growth companies.

Companies covered: Twilio, Facebook, Sea Limited, Alibaba, Crowdstrike, and more!