10 Lessons from Buffett’s 2021 Letter to Shareholders

This year's letter is jammed pack with insights!

Click HERE if you prefer to read it using your web browser.

Warren Buffett 2021 letter has dropped!

Buffett’s letters since his partnership years are jammed with insights.

And he taught me more than any business school ever could.

This year is no different. Here are my key insights:

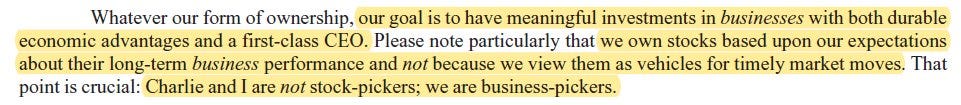

1. Buffett and Munger’s investing philosophy

Their goal is to look for businesses with both durable economic advantages and a first-class CEO.

2. Pick the right businesses and the stock price will take care of itself.

“…we own stocks based upon our expectations about their long-term business performance and not because we view them as vehicles for timely market moves.”

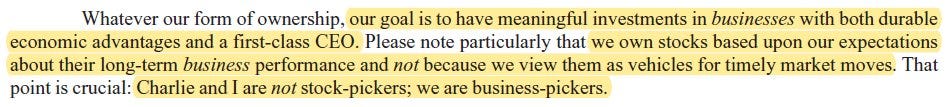

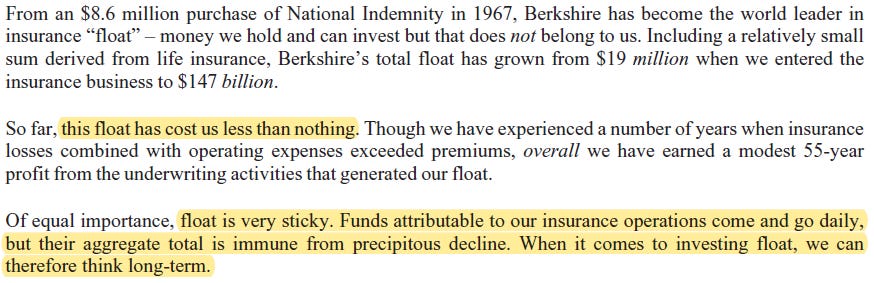

3. Warren uses leverage…

With his insurance businesses!

So far this leverage (aka float) has:

•Cost him nothing

•Gave him a sticky source of capital The latter is important.

A sticky source of capital allows Buffett to make long-term investments.

4. Look-through earnings

Berkshire owns 5.39% of Apple

But its share of earnings isn’t fully captured on its income statement.

Only the dividends is received.

But don’t forget…

There’s the retained earnings which is ploughed into share buybacks & reinvestment.

5. Why Buffett loves the insurance business

Because it fits Buffett’s rule for investing…

A company that can generate durable growth and it’s tough for competitors to catch up with them!

6. How Buffett likes his earnings

TLDR; After ALL expenses have been accounted for.

7. THREE ways to increase Berkshire’s value

1) Increase earnings power of wholly owned businesses or make more acquisitions

2) Buy shares of publicly listed businesses

3) Repurchase Berkshire’s shares

More on repurchasing Berkshire’s shares…

In Buffett’s 1999 letter, he outlines the conditions required for share repurchases to be value accretive:

1) The company has available funds—cash plus sensible borrowing capacity, AND

2) Its stock is selling in the market below its intrinsic value, conservatively-calculated.

8. Why Buffett loves teaching

Buffett started teaching investing 70 years ago.

“Teaching, like writing, has helped me develop and clarify my own thoughts.”

I will be running an investing course for beginners with my good friend, Max Koh.

Only for my subscribers, lock in the early bird discount by 28 Feb 2022, 9am!

» Go here now to get early bird special access to the course

9. Career advice for university students

Seek employment in:

1) the field and

2) with the kind of people they would select….

If they had no need for money. It’s not easy.

But don’t give up on the quest to hunt for a job where they will no longer be “working”.

10. The upcoming Berkshire’s meeting…

Will be a PHYSICAL one!

In Omaha on Friday, Apr 29 through Sunday, May 1.

Not enough of Buffett’s wisdom?

Then check out my earlier post on ALL of Buffett’s Berkshire’s letters.

I distill his insights from 1977 to 2020.

» Click HERE to read 17 Lessons From Warren Buffett’s Annual Letters To Shareholders