Click HERE if you prefer to read it using your web browser.

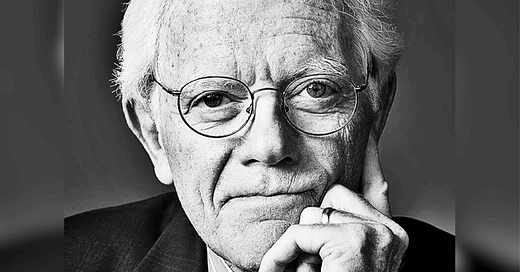

10 Investing Gems from Peter Lynch.

This legend inherited a $20 million fund and grew it to $14 billion.

Delivering a 29.2% annual return between 1977 and 1990.

Here is how he did it:

1. Hold on to your winners tightly.

Great businesses defy mean reversion.

Cut lousy businesses out.

The quote was so good that Warren Buffett cited it in his shareholder letter.

“Selling your winners and holding your losers is like cutting the flowers and watering the weeds.”

2. Volatility is the price of admission.

“People who succeed in the stock market also accept periodic losses, setbacks, and unexpected occurrences. Calamitous drops do not scare them out of the game.”

3. On how many stocks you should own.

Keeping track of dozens of companies is tough.

Finding dozens of great companies?

Even tougher. "Owning stocks is like having children.

Don't get involved with more than you can handle."

4. On making mistakes.

Don't tie your identity to a business.

Or let your ego get in the way.

"There's no shame in losing money on a stock. Everybody does it. What is shameful is to hold on to a stock, or worse, to buy more of it when the fundamentals are deteriorating."

5. Stocks are not just prices, it is ownership.

Never associate price movements with changes in business fundamentals.

In the short run, they are often disjointed.

“This is one of the keys to successful investing: focus on the companies, not on the stocks.”

6. Stop reading news.

It is the media's business to get eyeballs, not just report facts.

Under their lens, everything is BREAKING.

"While catching up on the news is merely depressing to the citizen who has no stocks, it is a dangerous habit for the investor."

7. Never FOMO and chase without due diligence.

Rubbish stock tips/takes are bountiful.

Do your due diligence.

"Never invest in any company before you've done the homework on the company's earnings, prospects, financial condition, competitive position, plans for expansion, and so forth."

8. Only your conviction can save you from periods of drawdown.

You can't borrow conviction from stock tips.

In fact, during drawdowns you'll discover who are the charlatans.

"The stock market demands conviction as surely as it victimizes the unconvinced."

9. Just because technology has made it simpler to invest, doesn't mean you lower your standards.

Stop swiping right at everything 😏

And also stop checking stock prices frequently. "In stocks – as in romance – ease of divorce is not a sound basis for commitment."

10. On holding cash.

Don't lower your standards.

"If you can't find any companies that you think are attractive, put your money in the bank until you discover some."

New to Investing?

Yes I am talking to YOU!

If you are new and overwhelmed by the thought of analyzing businesses…

We have a LIVE course covering important knowledge from how to find great businesses, to analyzing them and figuring out the valuations of these businesses!

It will be spread over 6 sessions of 2 hours each, from 21 March to 1 April 2022.

Few slots left, grab your spot today!